Tax Shield: Definition, Formula & Examples

The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. The use of a depreciation tax shield is most applicable in asset-intensive industries, where there are large amounts of fixed assets that can be depreciated. Conversely, a services business may have few (if any) fixed assets, and so will not have a material amount of depreciation to employ as a tax shield. It should be noted that regardless of what depreciation method is used the total expense will be the same over the life of the asset. Thus, the benefit comes from the time value of money and pushing tax expenses out as far as possible.

How Liam Passed His CPA Exams by Tweaking His Study Process

You may also look into the related articles below for a better understanding. Finally, we conclude on account of the above-stated cases that a tax shield can be utilized as a valuable option for effectively evaluating cash flow, financing, etc., activities. A 25 % depreciation for plant and machinery is available on accelerated depreciation basis as Income tax exemption.

How Accelerated Depreciation Works On Tax Savings?

Interest expenses on certain debts can be tax-deductible, which can make the entire process of debt funding much easier and cheaper for a business. This works in the opposite way to dividend payments, which are not tax-deductible. Therefore, depreciation is perceived as having a positive impact on the free cash flows (FCFs) of a company, which should theoretically increase its valuation. Because depreciation expense is treated as a non-cash add-back, it is added back to net income on the cash flow statement (CFS). Common expenses that are deductible include depreciation, amortization, mortgage payments, and interest expense. There are cases where income can be lowered for a certain year due to previously unclaimed tax losses from prior years.

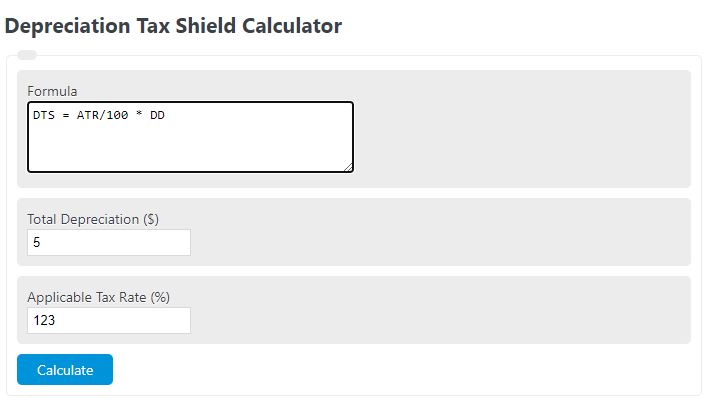

What Is the Formula for Tax Shield?

To calculate a tax shield, you need to know the value of your tax-deductible expenses and your own individual tax rate. Anyone planning to use the depreciation tax shield should consider the use of accelerated depreciation. This approach allows the taxpayer to recognize a larger amount of depreciation as taxable expense during the first few years of the life of a fixed asset, and less depreciation later in its life.

Depreciation Tax Shield Formula

Johnson Industries Inc., for example, has a piece of equipment that costs $75,000. The maximum depreciation expense it can write off this year is $25,000. The tax shield Johnson Industries Inc. will receive as a result of a reduction in its income would equal $25,000 multiplied by 37% or $9,250. Tax shields are essentially tools used to protect income from being taxable. They can take different forms, such as deductible expenses, tax credits, or depreciation allowances.

- There are cases where income can be lowered for a certain year due to previously unclaimed tax losses from prior years.

- A tax shield refers to tax deductions that an individual or business can take to lower their taxable income.

- The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

- A tax shield is a way for individual taxpayers and corporations to reduce their taxable income.

For example, if you had medical expenses of $15,000 and your income was $50,000, you could deduct the expense, and you would be taxed on only $35,000 of your income. This machinery has an estimated useful life of 10 years and a salvage value of $10,000. As for the taxes owed, we’ll multiply EBT by our 20% tax rate assumption, and net income is equal to EBT subtracted by the tax. In the final step, the depreciation expense — typically an estimated amount based on historical spending (i.e. a percentage of Capex) and management guidance — is multiplied by the tax rate.

By taking advantage of legitimate deductions, credits, or other specific tax provisions, individuals and businesses can legally lower their taxes and retain more of their earned income. A tax shield is a legal way for individual taxpayers and corporations to try and chapter 12 sales journal and sales return journal reduce their taxable income. The total value of a tax shield is going to depend on the tax rate of an individual or corporation and their tax-deductible expenses. Now, let’s look at how much a company can save in taxes by having assets that it can depreciate.

Since depreciation is a non-cash expense and tax is a cash expense there is a real-time value of money saving. For instance, if you expect to have a high income next year(s), it might be wise to hold on to be able to lower your income in the future and avoid paying a higher tax rate. If this year is unexpectedly successful, you might want to get as many deductions as possible now. Companies using a method of accelerated depreciation are able to save more money on tax payments due to the higher amount of possible tax shield. With the straight-line method, the tax shield will turn out to be lower, but it is still a way to cut down your business’s tax bill. If we talk about depreciation in simple terms, it is the simplest, but at the same time quite effective technique that allows you to preserve tangible assets directly within the company.